Principal Amount

- 3000

- 5L

Total Interest Payable

- 6

- 38

Loan Term (in months)

- 3

- 72

Get Personal Loans up to 2 Lakhs in 6 minutes

Select Language :

If you need ₹40,000 urgently, an instant personal loan is the fastest way to arrange funds. It can help you manage sudden expenses like paying school fees, fixing a broken appliance, or covering rent during a tight month. With Zype’s online personal loan, you can apply anytime, from anywhere. Just apply online, verify instantly, and get money credited straight to your bank. No paperwork, no queues.

When you manage a home, unexpected costs are part of the routine. A child’s school payment or helping a relative during an emergency. Small financial hiccups can quickly feel overwhelming without quick access to funds. That’s where a ₹40,000 personal loan can make life easier. It gives you quick access to funds exactly when you need them, without the stress of borrowing from friends or waiting in long bank queues.

With today’s digital loan apps, applying for a ₹40,000 personal loan is simple and convenient. Just fill in a few details, complete your KYC, and get instant approval with the amount transferred directly to your bank account within 24 hours. This small loan offers a quick and reliable way to keep your finances steady without depending on credit cards or friends for short-term help.

A ₹40,000 loan is an unsecured, flexible option for various needs such as solo travel or retreat, festive or wedding expenses, fitness investment like buying a cycle or a treadmill, or buying a new gadget. With platforms like Zype, you can get a 40 thousand loan instantly, with minimal paperwork and a simple eligibility check. The process to apply for a 40,000 loan is fully digital, ensuring fast approval and disbursal. So, if you need an instant 40,000 loan, this smart solution brings the funds you need at the earliest.

A ₹40,000 personal loan helps you turn plans into reality. Whether it’s taking a solo getaway, gifting during weddings or festivals, investing in fitness gear, or buying that new phone you’ve been eyeing. Through Zype, the process is quick and 100% digital. Apply online, complete instant verification, and get the amount credited straight to your account. No collateral, no hidden charges. Just fast, simple, and secure access to money when you need it most.

hoose a ₹40,000 personal loan from Zype when you need quick access to funds. Apply online in minutes, get instant approval, and receive money directly in your bank within 24 hours. Here’s why Zype’s instant loan app is the smart choice:

Note: All the Above details to be As per Zype’s Criteria

A ₹40,000 instant personal loan offers quick and reliable financial support for unexpected expenses. Cover urgent expenses like medical bills or quick repairs in just a few clicks. Here’s why an instant loan can make things simpler:

Complete a loan application in minutes and get quick loan approval.

Loan is disbursed within 24 hours of loan approval to help you manage urgent financial needs.

Get an instant loan without pledging any assets like property, gold, or any other valuable.This helps you utilise the loan amount without worrying about any assets. You get instant funds, without dipping into your savings.

Choose a repayment plan from 6, 9, 12 or 18 months.

The loan process is entirely digital. You can manage everything on the app or via the official website.

The interest rate is competitive and is determined based on your credit profile, income, and employment status.

A ₹40,000 personal loan offers a simple, secure, and speedy solution to cover your financial needs. Apply now with Zype and enjoy the ease of getting a ₹40,000 instant loan, without the hassle!

Before applying, calculate your EMI to plan repayments better.

Formula:

EMI=P×R×(1+R)N(1+R)N−1EMI = \frac{P \times R \times (1+R)^N}{(1+R)^N – 1}EMI=(1+R)N−1P×R×(1+R)N

Where:

Example:

EMI ≈ ₹3,699 per month

👉 Use the Zype EMI Calculator for quick results.

You can get an EMI options suited to your financial situation from Zype. The table below shows an example of the monthly EMI for different loan tenures for a ₹40000 loan at 18% annual interest rate.

| Loan Amount (₹) | Interest Rate (%) | Tenure (in months) | EMI (₹) |

|---|---|---|---|

| 40,000 | 18 | 6 | 7,021.01 |

| 40,000 | 18 | 9 | 4,784.39 |

| 40,000 | 18 | 12 | 3,667.20 |

| 40,000 | 18 | 18 | 2,552.23 |

Note: The above table is just for illustration purposes. The actual number may differ.

Getting a ₹40,000 personal loan is easy if you meet a few basic eligibility conditions. Zype keeps the process simple without any paperwork.

21 years and above

Monthly income of ₹15,000

650 and above is preferred

Salaried or must have a stable income source

Indian citizen with a valid bank account

Applying for a personal loan is quick and easy, especially with digital loan apps like Zype. For a 40000 personal loan, you require the following documents:

PAN card, Aadhar Card

Aadhar card, utility bills

Salary slips or bank statement (last 4 months), if you need to apply for a higher loan amount.

For ₹40,000 loan, the interest rate is determined based on your credit profile, income, and repayment history. Understand these charges along with the interest rate before you apply for a loan on Zype:

| Fees & Charges | Amount Chargeable |

|---|---|

| Interest Rate | Starting at 1.5% per month |

| Processing Fees | 2% to 6% of the loan amount |

| Late payment charges | In case of missed or late payments, the overdue interest with the late payment gets added to the outstanding loan amount |

Note: All the Above details to be As per Zype’s Criteria

A ₹40,000 personal loan can be a smart, flexible solution for everyday financial needs. It helps you manage short-term expenses smoothly without dipping into your savings. Whether it’s an emergency or an important plan, instant funds bring timely relief.

Handle costs like catering, outfits, or venue bookings with ease. Focus on the celebration while your loan takes care of the payments.

Cover flight tickets, hotel stays, or relocation costs effortlessly with a quick personal loan.

Pay for tuition, courses, or skill-based certifications that help you grow professionally.

Manage bills for medicines, consultations, or minor surgeries while waiting for insurance claims or reimbursements.

From fixing a leaky roof to repairing your car, a personal loan ensures you don’t have to dip into your emergency fund.

Buy the laptop, smart TV, or appliance you need without straining your budget.

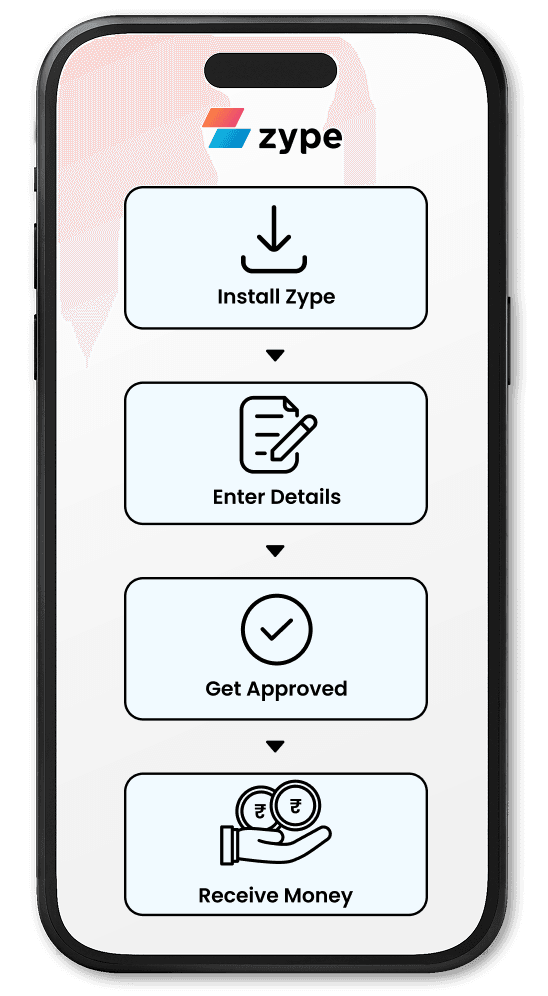

Need ₹40,000 loan urgently? Loan apps like Zype offer personal loans for urgent or emergency financial needs, with a 100% digital process. Follow these steps to get loan:

To get 40,000 rupees urgently, you can apply for an online personal loan. With digital apps like Zype, getting quick funds is easy, with instant approval and fast disbursal.

Yes, you can get a 40K personal loan. With digital apps like Zype, you get instant funds within 24 hours. Make sure to have a good credit score and fulfill loan eligibility for quick loan approval.

The minimum income to get a ₹40,000 personal loan varies as per the lender and ranges between ₹15,000 – ₹25,000. On Zype, you need a ₹15,000 minimum income to get a 40K personal loan.

Yes, it is possible to get a ₹40,000 personal loan without income proof. Personal loan apps line Zype offer loans, requiring only PAN and Aadhar details during application.

The processing fee can range between 0.5% – 6% of the loan amount. Check with your lender to know more.

No, a guarantor is not required for a ₹40,000 loan. However, if you have a low or zero credit score, you may need a guarantor with a strong profile to avail the loan.

Yes, a ₹40,000 personal loan can be used for varied reasons, including for any business expenses.

Select the loan details you want to know

Rahul Verma

I needed to get some repair work done in my house and take care of some personal expenses, for which I used a Zype loan. It was a great help for me.

Anisha Dhaka

I took a loan from Zype for my mother’s medicines. At that time, she was admitted to the hospital, and I didn’t have enough money to buy medicines or pay the hospital bills. Then, my friend suggested that I take a loan from Zype. The process was simple and easy, and within minutes, I got the loan.

Satya Prakash

I was in a very bad financial situation, and suffering from a heart condition —diastolic stage 2. Thank you so much Zype. I truly appreciate your support.

Educational only; not financial advice. Personal loans are offered by Zype, a regulated NBFC, as per final approval, internal credit policy, and RBI guidelines.

Borrower Responsibility: Read the KFS and Loan Agreement carefully before accepting any offer. Rates, fees, and charges vary by borrower profile, and non-repayment can affect your CIBIL score and financial stability.

Grievance Redressal: For issues, first use the NBFC’s grievance redressal mechanism. Unresolved complaints can be escalated under the RBI Integrated Ombudsman Scheme.