Your Monthly EMI Is

Total Interest

Total Amount Payment

Loan Amount (in rupee)

- 3000

- 5L

Interest Rate (%)

- 6

- 38

Loan Term (in months)

- 3

- 72

Get Personal Loans up to 2 Lakhs in 6 minutes

Select Language :

Loan Amount (in rupee)

Interest Rate (%)

Loan Term (in months)

urgent expenses without needing to pledge any assets as collateral. At Zype, this is offered as part of a flexible personal loan, allowing you to draw ₹20,000 (or any amount up to your approved limit) whenever you need it. It can be used for monthly bills, rent, medical costs, or unexpected cash needs. Since the amount is smaller, it’s often easier to qualify for and may be approved faster than larger loans. This type of 20000 personal loan is designed for accessibility and speed. With features like minimal digital documentation and fast disbursal, a ₹20,000 personal loan can provide the financial support you need, exactly when you need it.

When an unexpected bill shows up, your phone needs urgent repair, or travel plans can’t wait, a quick ₹20,000 personal loan can help you manage it swiftly and securely. If you’re thinking, “I need 20,000 rupees loan urgently,” a digital lender like Zype offers a streamlined process. This provides the financial cushion you need, right when you need it. This makes borrowing as simple as tapping your phone, because life’s emergencies shouldn’t wait.

Apply in as little as 6 minutes with your PAN & Aadhaar and get an application status in as fast as 60 seconds.

Get funds credited directly to your bank account, often within 24 hours of final approval.

Enjoy a paperless journey with Aadhaar-based e-KYC for hassle-free access.

Repay with easy EMIs over 6, 9, 12 or 18 months, with rates starting at 1.5% per month (18% p.a.).

Available for salaried professionals.

Transparent terms with clear interest rates and fees. All charges are clearly mentioned in the loan agreement.

Here are the basic requirements you need to meet. Check your eligibility by applying on the app, and check your potential ₹20,000 loan limit instantly.

21 years or above

Citizen of India

Valid PAN & Aadhaar card

Salaried individual

Net monthly income of at least ₹15,000

Get an instant ₹20,000 loan with minimal digital paperwork. As per RBI guidelines, all borrowers must complete KYC.

PAN Card and Aadhaar Card (for e-KYC and address proof)

Aadhar Card/ Passport/ Ration Card/ Voter ID Card/ PAN Card/ Driving License/ Utility Bills of at least the last 3 months.

Salary account bank statements of the last 6 months, recent 3 months' salary slips, and ITR/Form 16.

At Zype, interest rates are tailored to your credit profile, meaning your credit profile (including your CIBIL score or other bureau score), repayment history, and income decide the rate you get. If you maintain a strong credit history, you may enjoy loans at more affordable rates. Plus, we provide complete transparency. All charges are clearly explained upfront in the loan agreement, with no hidden fees.

| Fees & Charges | Amount Chargeable |

|---|---|

| Interest Rate | Starting from 1.5% per month. The final rate depends on your risk profile. |

| Processing Fees | Between 2% to 6% of the approved loan amount (+ applicable GST). |

| Overdue EMI Charges | Specific charges for late payment, including potential daily interest and a fixed penalty, will be clearly detailed in your loan agreement. (Refer to your loan agreement for specific charges). |

With Zype, you can enjoy the convenience of choosing repayment tenures of 6, 9, 12 or 18 months and manage your budget with ease. You can also use an intuitive loan EMI calculator to check the monthly instalment amount for a ₹20,000 personal loan.

Check out the sample breakdown of an estimated EMI amount on an instant ₹20,000 loan:

| Loan Amount (₹) | Interest Rate (%) | Tenure (in months) | EMI (₹) |

|---|---|---|---|

| 20,000 | 18 | 6 | 3,510.50 |

| 20,000 | 18 | 9 | 2,392.20 |

| 20,000 | 18 | 12 | 1,833.60 |

| 20,000 | 18 | 18 | 1,276.12 |

Note: The above table is just for illustration purposes. The actual number may differ.

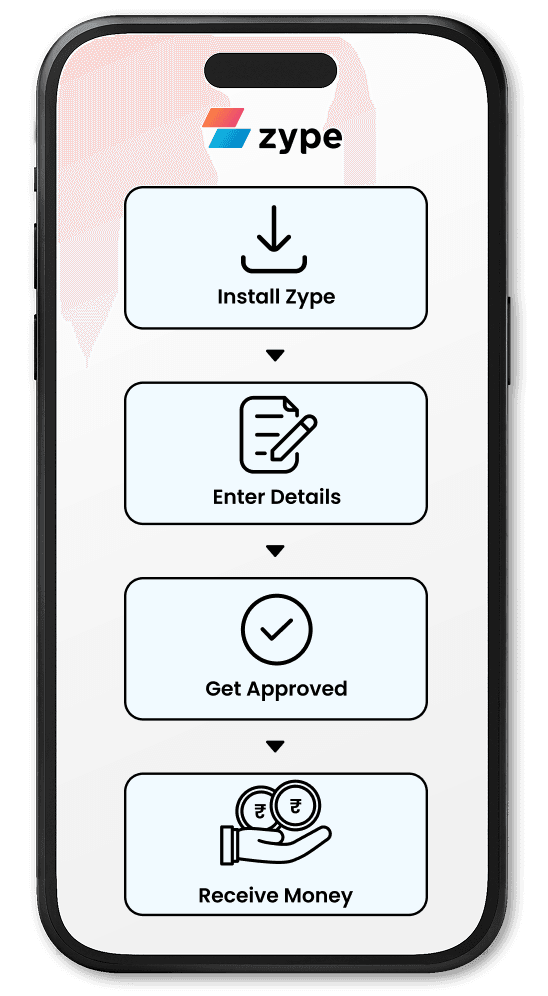

Need ₹20,000 urgently? With a digital lender like Zype, you can apply in minutes, get instant feedback, and receive the money directly in your bank. Here’s a step-by-step guide:

A 20000 personal loan can cover urgent, everyday expenses without the stress of paperwork or delays. This type of emergency loan 20,000 online is designed to cover needs like:

Yes, it is possible to get a ₹20,000 loan quickly from digital lenders. With Zype, the process is designed for speed – you can get an application status in as fast as 60 seconds and, post-approval, disbursal can happen in as little as 24 hours.

This is a common question. If you are new to credit and have no CIBIL score (a ‘NA’ or ‘-1’ score), some lenders, including Zype, may still consider your application using an alternative credit assessment model. However, no lender offers a “20,000 loan without cibil score check,” as all regulated lenders must assess creditworthiness. If you have a low CIBIL score, approval may be more difficult.

No, a loan “without documents” is not possible. All regulated lenders in India, as per RBI guidelines, require mandatory KYC documents (Source: RBI KYC Master Direction – Note: This link should open in a new tab). However, the process is 100% digital and paperless. This feels like “no documents” because you only need to provide your Aadhaar and PAN details online, with no physical paperwork, making it ideal for someone searching for a 20,000 loan urgently without documents in the physical sense.

Lenders typically require a minimum monthly income, which can range from ₹15,000–₹20,000 for a personal loan. At Zype, the minimum net monthly income required is ₹15,000. To check your specific eligibility, you can download the Zype app and apply to get your limit in just a few minutes.

Yes, all personal loans from Zype are unsecured, which means you do not need to pledge any collateral or asset.

Several banks and NBFCs in India provide short-term personal loans. If you are thinking, “I need a 20,000 rupees loan urgently,” digital lenders like Zype are often the fastest option. Using a personal loan app that has an EMI calculator helps you choose the best repayment plan.

To get the lowest interest rate, maintain a good credit profile and timely repayment history. A CIBIL score above 750 is generally preferred by lenders for the best rates. (Source: CIBIL – https://www.cibil.com/what-is-cibil-score). Online loan apps offer rates based on your risk profile.

No, you need both a PAN card and an Aadhaar card to get a loan. A PAN card is used to check your credit history and financial identity, while an Aadhaar card is used for e-KYC and address verification as per RBI guidelines.

Repayment tenure for a ₹20,000 personal loan online usually ranges from 6 months to 12 months. Choose a tenure that balances affordability and total interest costs.

To choose your EMI Plan for a ₹20,000 personal loan, use an easy cash loan online app’s EMI calculator to decide the best plan. Enter the loan amount, tenure, and interest rate to find a suitable EMI. Adjust tenure to balance EMI size and total repayment.

No, you need both a PAN card and an Aadhaar card to get a loan. A PAN card is used to check your credit history and financial identity, while an Aadhaar card is used for e-KYC and address verification as per RBI guidelines.

Select the loan details you want to know

Rahul Verma

I needed to get some repair work done in my house and take care of some personal expenses, for which I used a Zype loan. It was a great help for me.

Anisha Dhaka

I took a loan from Zype for my mother’s medicines. At that time, she was admitted to the hospital, and I didn’t have enough money to buy medicines or pay the hospital bills. Then, my friend suggested that I take a loan from Zype. The process was simple and easy, and within minutes, I got the loan.

Satya Prakash

I was in a very bad financial situation, and suffering from a heart condition —diastolic stage 2. Thank you so much Zype. I truly appreciate your support.

Educational only; not financial advice. Personal loans are offered by Zype, a regulated NBFC, as per final approval, internal credit policy, and RBI guidelines.

Borrower Responsibility: Read the KFS and Loan Agreement carefully before accepting any offer. Rates, fees, and charges vary by borrower profile, and non-repayment can affect your CIBIL score and financial stability.

Grievance Redressal: For issues, first use the NBFC’s grievance redressal mechanism. Unresolved complaints can be escalated under the RBI Integrated Ombudsman Scheme.